As the COVID-19 pandemic caught hold early this year, a small drug company outside Philadelphia was struggling to market a compound that could help patients battling for their lives.

Paratek Pharmaceuticals had spent more than 20 years developing and testing an antibiotic named omadacycline (Nuzyra), which went on sale in the United States in 2019 for use against bacterial infections. Although antibiotics can’t fight the virus that causes COVID-19, almost 15% of people hospitalized with the disease go on to develop bacterial pneumonias, some of which are resistant to existing antibiotics.

Before COVID-19, antibiotic resistance was estimated to kill at least 700,000 people each year worldwide. That number could now climb as more people with the viral disease receive antibiotics to treat secondary infections, or to prevent infections that come from being on a ventilator. That’s where a drug such as omadacycline might help—if it can be delivered to people in time to save lives.

“COVID is a wake-up call,” says Evan Loh, chief executive of Paratek, which has offices in Pennsylvania and Boston, Massachusetts. Diagnostics, antibodies and vaccines are all key to preparing for a pandemic, he says, and “We need antibiotics, to give people the best chance of surviving this particular infection.” But drug makers who produce antibiotics face unique challenges.

In a bitter paradox, antibiotics fuelled the growth of the twentieth century’s most profitable pharmaceutical companies, and are one of society’s most desperately needed classes of drug. Yet the market for them is broken. For almost two decades, the large corporations that once dominated antibiotic discovery have been fleeing the business, saying that the prices they can charge for these life-saving medicines are too low to support the cost of developing them. Most of the companies now working on antibiotics are small biotechnology firms, many of them running on credit, and many are failing.

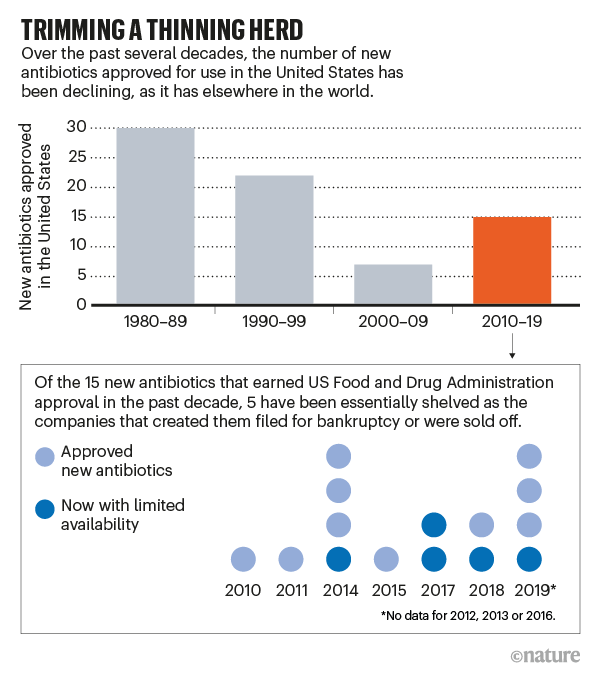

In just the past two years, four such companies declared bankruptcy or put themselves up for sale, despite having survived the perilous, decade-long process of development and testing to get a new drug approved. When they collapsed, Achaogen, Aradigm, Melinta Therapeutics and Tetraphase Pharmaceuticals took out of circulation—or sharply reduced the availability of—5 of the 15 antibiotics approved by the US Food and Drug Administration (FDA) since 2010 (see ‘Trimming a thinning herd’).

Paratek has so far avoided the rip tide that pulled so many others down, through a combination of conservative spending, experience and good fortune, including a lucrative government contract awarded late last year. But omadacycline’s earnings, although steady, have not yet ensured Paratek’s long-term survival.

“At the end of the day, Paratek is still going to have to sell a drug,” says David Shlaes, a former pharmaceutical executive who is now an antibiotic-development consultant and author. “And it’s not at all clear it’s going to be able to sell as much as it needs to sell to make a profit.”

Costly business

Bringing a new antibiotic to market represents a Herculean feat. Only about 14% of antibiotics and biologicals in phase I trials are likely to win approval, according to the World Health Organization. A team of economists estimated in 2016 that the cost of getting from first recognition of an active drug molecule to FDA approval in the United States was US$1.4 billion, with millions more required for marketing and surveillance after approval. When companies such as Eli Lilly or Merck made antibiotics in the mid-twentieth century, those costs could be spread across their many divisions. And when, as used to happen, big companies bought smaller ones whose new drugs showed preclinical promise, the purchase price covered any debt the small companies had incurred.

Those business models no longer exist. The trio that runs Paratek knows this because all three are big-company veterans. Loh worked at Wyeth Pharmaceuticals in Philadelphia with Adam Woodrow, Paratek’s president and chief commercial officer, and with Randy Brenner, chief development and regulatory officer, on the successful antibiotic tigecycline (Tygacil), which was approved in 2005. (Wyeth sold its antibiotic portfolio to Pfizer in 2009.)

“When you come from a big company to a small company, your focus becomes: ‘How do I make sure this company survives?’” says Brenner, who previously also worked at Pfizer in New York City and at Shire in Lexington, Massachusetts (now a subsidiary of Takeda Pharmaceutical Company in Tokyo). “Bigger companies don’t need to think like that. No matter what happens to a product, the company survives.”

Tigecycline is based on tetracyclines, one of the earliest classes of antibiotic; they were first used in 1948, just six years after penicillin’s debut. Over the years, successive generations of tetracyclines arrived on the market and were undermined by resistance. Tigecycline’s structure incorporates tweaks that let it avoid those resistance mechanisms, but this comes at a cost: the drug can only be given intravenously.

This was a limitation. An intravenous drug would usually be given in hospitals and medical centres, making it both more expensive and less accessible to patients. So, as tigecycline was being developed, physician-researcher Stuart Levy—one of the giants of US antibiotic-resistance research, based at Tufts University in Boston—proposed formulating yet another tetracycline relative that could also be delivered in pill form. With that goal in mind, he co-founded Paratek in 1996 with Walter Gilbert, a molecular biologist at Harvard University in Cambridge, Massachusetts, who had won a share of the 1980 Nobel Prize in Chemistry.

In its early years, Paratek formed partnerships with larger companies—the German company Bayer, then Merck, then Novartis in Basel, Switzerland. But each deal dissolved as the corporations shifted focus or regulatory changes made omadacycline a bad financial bet. By 2012, when Loh was recruited, Paratek had accomplished phase I and II clinical trials of its compound, and had amassed abundant data on its safety—but it was running out of money. Loh cut the staff from about 34 people to 6, closing the research laboratory while the executive team scrounged for funds. For nine months, they went without salaries.

“I had an insolvency attorney on retainer for 18 months,” he recalls. “I talked to him every week. Should I open the doors on Monday? Did I have enough cash to do that?”

In 2014, Paratek went public in a manoeuvre called a reverse merger, folding itself into a US company named Transcept Pharmaceuticals that was already listed on the NASDAQ stock exchange, but which had seen disappointing sales and was running with a skeleton crew. The deal earned Paratek $110 million, enabling it to launch omadacycline’s phase III trials and begin a careful restaffing programme. In October 2018, the FDA approved the drug in oral and intravenous formulations against two conditions: complicated skin infections and community-acquired bacterial pneumonia. The 22-year journey was over—but the landscape into which omadacycline would launch was nevertheless still hazardous.

Loh, a cardiologist who had led transplant programmes at two academic medical centres before turning to the pharmaceutical industry, knew that the drug was needed. But he was aware it would not be easy.

“There’s nothing that happens in a hospital that can be successful if you don’t have an antibiotic,” he says. “You can’t have surgeries. You can’t have transplants. You can’t do anything. We have a product that we believe saves lives. Until we can make that successful for the long term, our mission is not done.”

Limited lifespan

Antibiotics present an enduring economic puzzle. These drugs changed the world. Yet despite their unique power, the free market doesn’t value them.

The reasons are complex. Start with the obvious: antibiotics kill bacteria, living things that are constantly adapting to threats against their survival. As soon as a new compound is used, pathogens start evolving strategies to foil the attack. That means an antibiotic’s useful life, and thus its earning potential, can be limited—a situation that doesn’t occur for most other drugs.

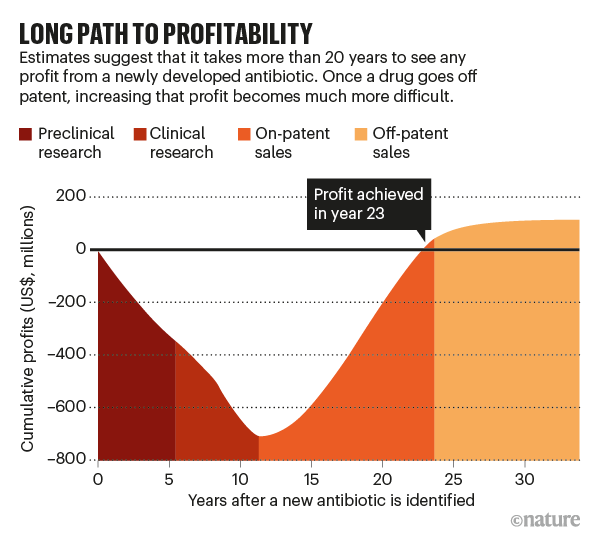

The duration of a new antibiotic’s lifespan wouldn’t be that important if a company could sell a lot of it quickly, but both structural and ethical barriers work against that (see ‘Long path to profitability’). Take the structural ones first. Relatively few patients have resistant infections that need treatment with new antibiotics, whereas most other drug categories are used to treat large numbers of people. The US Centers for Disease Control and Prevention estimates that there are 2.8 million resistant infections annually in the United States. For comparison, 7.4 million people in the United States take insulin to treat diabetes on a daily basis.

By one estimate, a new antibiotic needs to make at least $300 million in annual revenue to be sustainable. Other researchers estimate that the entire US market for new antibiotics that work against carbapenem-resistant Enterobacteriaceae—one of the most resistant and most stubborn classes of infection—is $289 million per year.

In other words, “there’s room in this marketplace for maybe one drug”, Shlaes says. “There’s not room for more than one drug if people want a return on their investment.”

Only a few of the companies now making antibiotics earn $100 million or more a year from them, according to analyses by the investment firm Needham in New York City. Most of the rest hover between $15 million and $50 million per year.

Then there are the ethical quandaries. Because any exposure of bacteria to an antibiotic risks the development of resistance, using that drug to treat one patient risks diluting its power to save others in the future. Thus, rules observed across health care, broadly called antibiotic stewardship, call for new antibiotics to be deployed slowly. That protects their reliability in the long term, but ruins their sales. For instance, in 2018, three new antibiotics—including the one made by recently bankrupt Achaogen—were used in only 35% of cases that would have qualified for them. That was a win for stewardship, perhaps. It was a literal loss for the companies whose drugs would otherwise have been used.

John Rex, a physician and long-time drug developer who is chief medical officer at the antifungals company F2G in Manchester, UK, and Vienna, sums up the paradox in this way: “Invent a bad antibiotic, and no one will use it. Invent a really good antibiotic, and really no one will use it.”

Into the abyss

The 100-person team that makes up Paratek approached the end of 2019 in an unsettled mood. They were staring into what Woodrow calls “the abyss of commercialization: this three-year period where you spend a tremendous amount of money before you get any traction in terms of real sales”. The antibiotic was selling steadily, but slowly—it was on track to earn $13 million that year. Meanwhile, Woodrow, Loh and Brenner had committed to doing post-approval studies and surveillance that they estimated would cost $70 million. And they had lost a guiding light: Levy, their co-founder, died in September 2019.

Then Christmas came early. The Biomedical Advanced Research and Development Authority (BARDA), a US federal agency, awarded Paratek a 5-year, $285-million contract to procure omadacycline for front-line troops who might be exposed to the bioweapon anthrax. (The purchase validated Levy’s early insight on the value of an oral drug: endangered troops could pop the pills and move on, rather than be tied to intravenous drips.)

On receiving the news, Loh felt like he could finally exhale. “This is a massive number—a gift,” he said not long afterwards. “It gives us time to gain traction.”

The BARDA money acted like a bridge across the chasms that other companies had fallen into. In a small way, it also demonstrated the potential of incentives for repairing the antibiotic market, which policymakers in the United States and Europe have been debating for several years. There are two types, referred to as push and pull. ‘Pushes’ propel new drug candidates from small companies through clinical trials and past approval. ‘Pulls’ aim to ease the financial crunch after approval, when companies must promote their drug without violating antibiotic stewardship.

Push incentives have had some success. The non-profit organization CARB-X (Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator), based at Boston University, has gathered about $500 million in funding from US, UK and other European governments and philanthropies, and is distributing the money to small companies. Since CARB-X was founded in 2016, it has given 67 companies about $250 million to support promising preclinical and phase I research.

BARDA—which is funding the separate search for coronavirus vaccines and therapeutics—also gives push grants that support companies doing the later clinical trials that bring drugs to approval. However, BARDA’s contract with Paratek was different. It was effectively a pull incentive, an infusion of cash arriving after omadacycline had been approved, at a point when post-approval surveillance and studies to support use of the drug for other infections would eat up slender earnings.

Other forms of pull incentive have been proposed by analysts and lawmakers, among others, and considered by the US Congress, but they are much more controversial. These range from granting pharma companies extra time before other drugs they own become generic, called extended market exclusivity, to giving companies market-entry rewards of billions of dollars that release them from the need to push sales of their drug, which would otherwise accelerate the development of resistance. Yet another proposed pull incentive—which would raise the reimbursements paid to hospitals by the US government for new antibiotics—was briefly added to the $2-trillion US stimulus bill written in response to the coronavirus pandemic. The incentive was taken out again before the bill became law.

No one has yet found a path past political reality: in the eyes of many voters and politicians, pharma companies are opportunists, inflating US drug prices to unconscionable heights. There were multiple congressional hearings on drug prices in 2019 alone, and in July, President Donald Trump signed several executive orders aimed at forcing prices down. Making things easier for any drug company, even a small one producing a much-needed antibiotic, faces strong political resistance.

Alan Carr, a molecular biochemist and senior analyst at Needham, says there is not yet a clear path to what works to support antibiotic research—not for incentives, and not for investors, either. “What has complicated things for investors is that there is a need for new antibiotics—but not in every space within antibiotics,” he says. “There are certain infections where there’s a real unmet need where we don’t have any antibiotics. And then there are other areas where we have plenty. Unfortunately, what has happened is that investors have lumped the whole space together. So they want nothing to do with any of them.”

Pandemic curveball

The BARDA contract turned Paratek from a company with less than a year’s worth of cash in the bank to one that could count on funding to the end of 2023. That guaranteed its immediate future, although it did nothing to solve the long-term problem of needing to earn more from the drug than the market seemed willing to pay. And then the coronavirus hit.

When cases of SARS-CoV-2 started increasing in the United States, Loh and his team were unnerved. The Paratek sales force had been doing the normal rounds, explaining omadacycline to infectious-disease specialists and hospital pharmacists, hoping to have it picked up by the formulary committees that govern which medications hospitals routinely keep to hand. Its work was paying off. Month after month, sales of omadacycline were rising by more than 10%. When the lockdowns started, all of those meetings ended. The company worried its sales would stall as well. But in monthly data gathered since the epidemic began, the steady increase has continued.

“New prescribers, in a lockdown period—I expected that to go to zero,” says Christine Coyne, Paratek’s vice-president of marketing. “But we are still seeing double-digit growth.”

It is too soon to say what drives those sales. Enough case reports have now been published for researchers to feel confident that bacterial pneumonia is a complication of COVID-19 in 15–20% of patients. And in parts of the United States, the most common cause of bacterial pneumonia (Streptococcus pneumoniae) is resistant to azithromycin, the most common generic antibiotic, in up to 50% of cases. That could drive adoption of a new drug for which resistance has not been recorded. Other publications confirm that significant amounts of antibiotics are being prescribed to people with COVID-19 who are on ventilators, even when pneumonia has not been diagnosed (for a review, see ref. 7). This is an insurance policy against patients getting hospital-acquired infections, and because, in the absence of enough personal protective equipment, the procedures needed to confirm bacterial pneumonia are too risky for staff to undertake.

As a side effect of the pandemic, many other antibiotics are in short supply. That’s a result of both interruptions in international trade—the active ingredients of most antibiotics come from China—and domestic influence. For instance, after Trump announced his support in March for the unproven and now largely discredited combination of hydroxychloroquine and azithromycin, several manufacturers of azithromycin announced that panic buying had triggered shortages.

If those events are boosting sales, that is to Paratek’s benefit. They also underline the good fortune of the BARDA contract coming when it did. The company’s supply chain avoids China and is based entirely in Europe. And, as a condition of protecting national defence, a clause in the BARDA contract requires the company to build a parallel supply chain fully within the United States, to avoid disruptions from any future outbreaks.

To the Paratek team, omadacycline’s applicability to this ongoing crisis is validation of the company’s commitment to stick with a product that it believed was needed. Equally, it has demonstrated how important it is to anticipate emergencies, and to provide for crucial medical interventions before one begins. The United States failed to do that for masks, respirators and other equipment that protects health-care workers from infection. It almost failed to do that for the provision of antibiotics, too.

“Coronavirus ought to say to the public, ‘If you don’t have technology on the shelf when something like this happens, you can’t wait a year or two—or even three or five—in order to get it there,’” Loh says. “You can’t be at the bedside and say to a company: ‘Can you make this for me today?’”

This article is reproduced with permission and was first published on August 19 2020.